In a recent comprehensive study conducted by CoinGecko, the findings reveal a striking reality in the cryptocurrency landscape, shedding light on the fate of an extensive number of digital assets. Out of the staggering 24,000 cryptocurrencies that have emerged, a substantial 14,000 are reported to be inactive, representing a significant portion of the market that has ceased functioning.

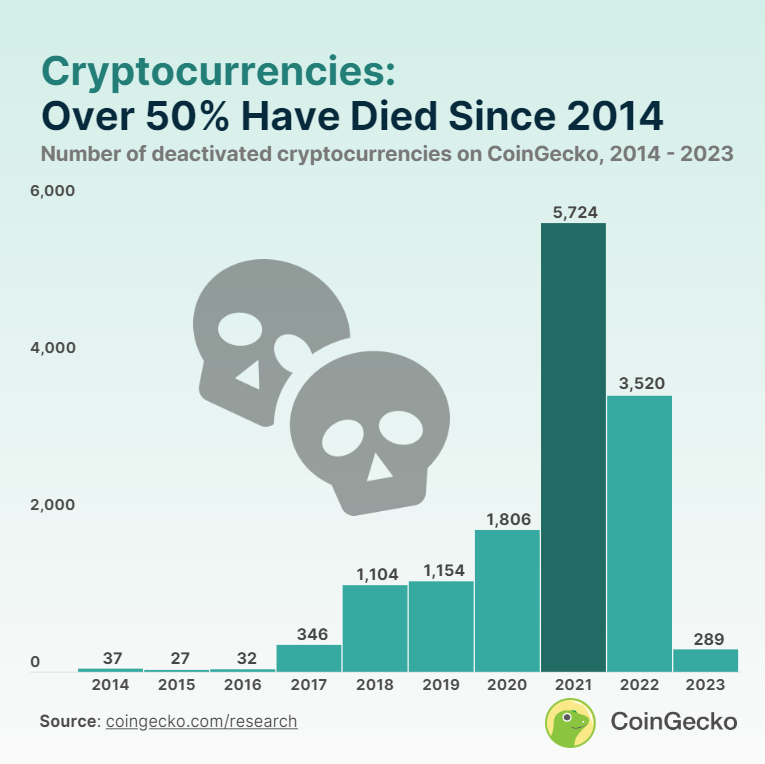

Source: Number of deactivated cryptocurrencies (2014-2023)

The research, spanning the period encompassing the 2020-2021 bull run, underscores the astonishing fact that more than half of the defunct cryptocurrencies, totaling 7,530, have succumbed to inactivity. This phenomenon is attributed to the surge in popularity of memecoins, characterized by their whimsical nature and the ease with which tokens can be deployed. The study reveals that many memecoin projects, often initiated without a tangible product, experienced a swift demise after a brief stint in the market.

Of particular note is the fate of cryptocurrencies introduced during the 2021 period, totaling 5,724, which has borne the brunt of this phenomenon. As of January 2024, a substantial portion of these 2021-born digital assets has met their demise, highlighting the challenges and volatility inherent in the cryptocurrency ecosystem.

This research not only serves as a testament to the dynamic and evolving nature of the cryptocurrency market but also underscores the importance of due diligence for investors navigating this complex landscape. As the industry continues to mature, the study by CoinGecko serves as a valuable resource for understanding the patterns and factors influencing the life cycle of cryptocurrencies.

Over 70% of the cryptocurrencies listed on the platform in 2021 have died, making 2021 the worst year for project launches. This is followed by over 3,520 crypto of 2022 that are no longer active.

The numbers are calculated on the basis of three circumstances as mentioned in CoinGecko methodology (Read here):

- Cryptocurrencies which are dead have not shown any trade activity within last 30 days.

- Projects are revealed as a scam, through verifiable sources.

- Projects request to be deactivated.